Tesla has come out with their own insurance plan for their consumers in California. They claim the plan should “roll out to other states” (last stated by Mr. Musk on the FY2019 investor call in January 2020) in the future and hopefully the rest of the world eventually.

Part 1: Tesla Insurance Review

Yes, the new Tesla insurance launched last year, but as with many products and services, the first few months or even years are rocky and improvements need to be made. Is getting insured with Tesla the right move? What is the experience of Tesla Insurance like? Let’s take a look.

Pros

- With the built-in sensors, Tesla gathers all the data they need to provide the proper rates by assessing what type of driver you are. This allows Tesla to beat out the competition with a more detailed risk model, which can in turn lead to lower prices in certain situations. It’s unclear how much this factors into your rate as of now, however.

- They know their cars, which also puts them in a better position to repair and provide better services at the Tesla Service Centers.

- With the data collected and knowledge about their own cars, they can in turn provide better coverage after an incident in certain situations.

- Any of the downsides could improve at any time, as Tesla uses a Silicon Valley-style strategy of “launch fast and continuously improve” for all their services and vehicles. So the downsides of today may be addressed tomorrow. Stay tuned :)

Cons

- Since they are new to the insurance game, does Tesla have the expertise on claim handling and regulations involved in offering and selling insurance?

- As of now, the insurance policy is only available in California. What about the rest of the world, especially Hong Kong where a significant number of Tesla drivers reside?

- They plan to include how much you use autopilot into your premium calculation in the future. This could lead to higher premiums if you don’t use autopilot much, or didn’t shell out extra for the Full Self Driving package.

Price comparison

The large price decrease in insurance premiums for certain users can be substantial if you are insured by Tesla themselves. See some price comparisons from this Reddit thread below.

For some users it was more expensive:

- User elmexiken said: “Wow….It got WAY cheaper for me. $260 yesterday $120 today. Comes with more coverage than I currently have. I’m excited to move to it.”

- User Otto_the_Autopilot: “Geico $223, Tesla $134.”

- user ss68and66: “Much better algorithm, I can confirm 20% cheaper than AAA”

- user aspyeros “Paid $466 before. Paying $269 now. Almost a 43% saving. Wow.”

- user theogravity: Definitely comparable now. Farmers: $108.33. Tesla: $112.65. This is using the same specs as my current insurance plan.

For other users it was less expensive:

- user soapinmouth asked: “Hmm much cheaper now for me dropped from over $200 to $140. Now the question is, are the savings worth the risk of dealing with tesla customer service for claims? I might wait to hear how it goes with others first.*

- user SofiaIchiban: “Geico $130, Tesla $125 for same coverage. Yesterday it was $225 before algorithm update.”

- user panerai388: “Tesla: $2072/year Travelers: $1869/year”

- user milogoestomars: “Currently paying [with Mercury]: $96/mo. Tesla Quote: $125/mo”

- user spasewalker: Tesla’s coming in about $30-40 a month more than Geico for me. Bummer!

Part 2: The next-gen competition

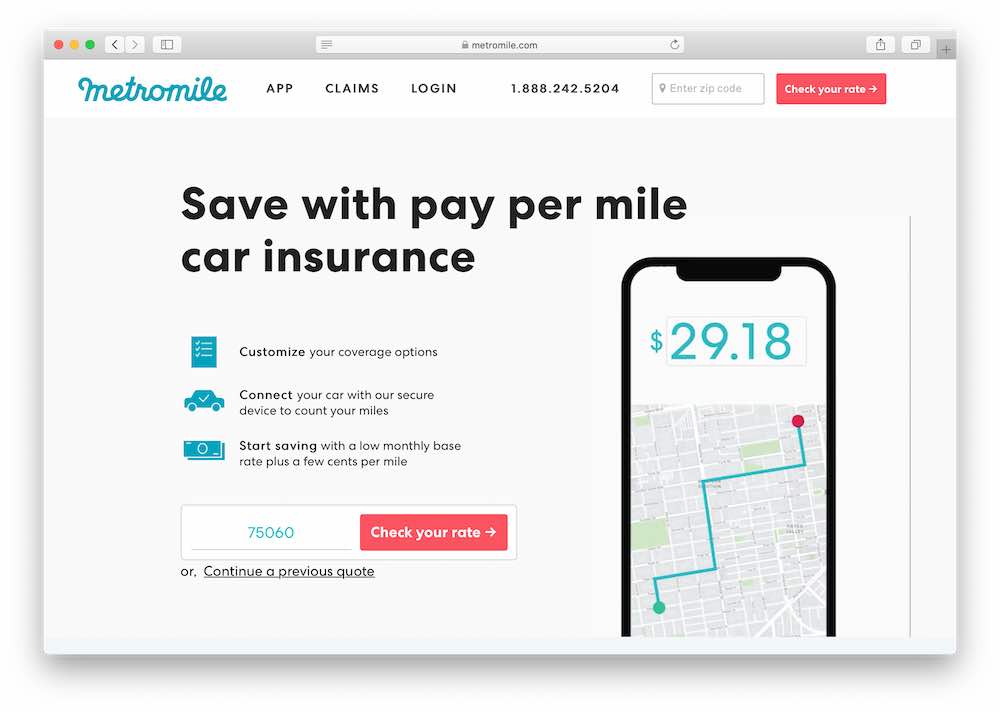

Metromile Insurance – Pay-Per-Mile Insurance

Metromile is the original next-generation insurance company. Strongly recommended for their novel model: you pay per mile you drive – so when you’re not driving, you’re not paying. If your Tesla is sitting in the garage on the weekends while you bike around, or your commute is only a short distance, then Metromile can be very competitive.

The quote and claims flow is online-only – no sitting in phone lines.

Unlike Root Insurance below, the price you pay does not take your driving style into account.

Their pricing is very competitive in most states, even if you do drive. But urban drivers will definitely see the biggest wins here.

They currently cover 8 states: Arizona, California, Illinois, New Jersey, Oregon, Pennsylvania, Virginia and Washington. If you’re in another state, Root may be a better option.

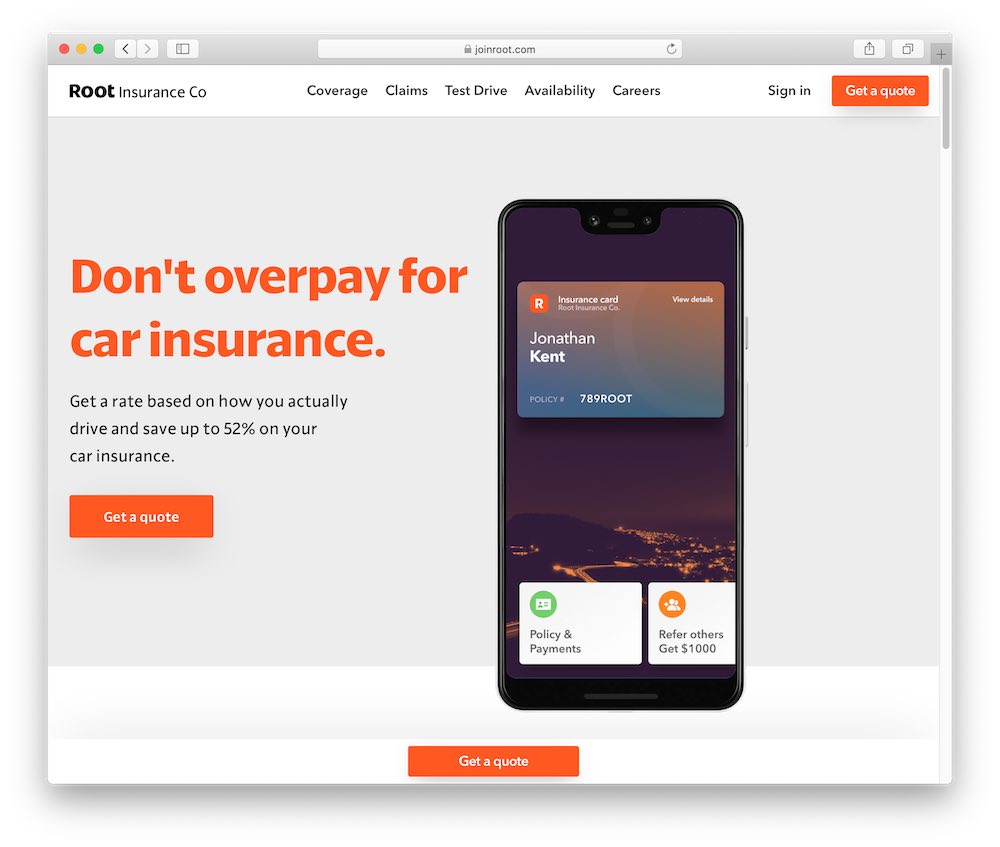

Root Insurance - Mobile-first Insurance

Multiple Next-Gen Insurance companies have started in the past couple of years, beyond the traditionals like GEICO etc. We think this mobile-first, connected insurance experience is a valid comparison for Tesla insurance, and so will present two alternatives here.

One appealing fact about Root Insurance is the rate is largely based on your driving style. Your driving habits will determine how much you pay. They believe better drivers should pay less premium (and we agree)!

They’re also available in 30 states, so if Tesla Insurance is not available in your state yet, this is a great alternative. They will be nationwide in the near future

They have an app that offers a quick and easy assessment on the recommended coverage plan. The best part is they make the whole process as easy as pie: They do the legwork and notify you on which coverages are mandatory in your state and which are optional.

Amazingly, Root insurance has rolled out a new discount policy for Tesla drivers! Having first hit the market in 2017, it has since picked up steam. While others are hiking up the premiums on Teslas, why has Root decided to go in the opposite direction? The answer is simple. According to them, Tesla cars get into fewer accidents. They feel the industry should adjust the rates to reflect that.

Never do you need to wait in lines or on the phone – with Root, everything can be done online - it’s all within the app. Even claims!

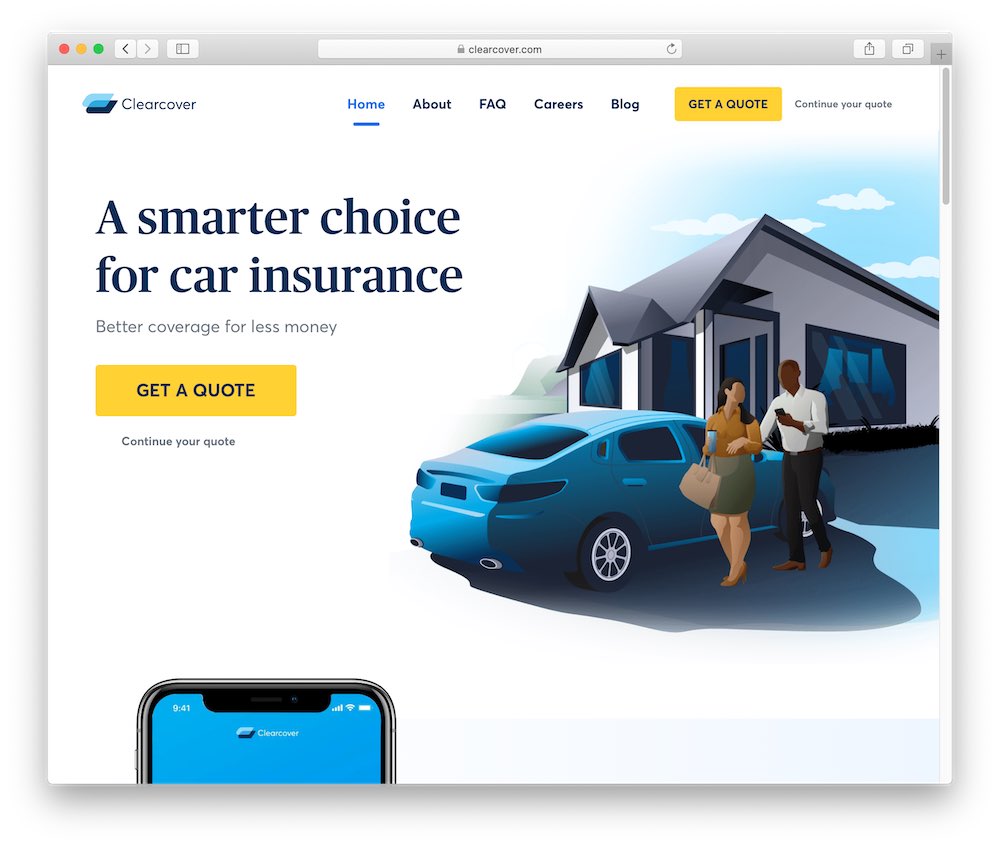

Clearcover Insurance – Better, more affordable online auto insurance.

Relatively new to the insurance industry, Clearcover provides one of the lowest competitive rates around. If you live in one of their supported states then you are in luck: California, Utah, Arizona, Illinois and Ohio are currently supported, but they tell us they have many new states to come in 2020. So you have the freedom to actively compare the pros and cons of Tesla insurance with Clearcover, and get good EV insurance in all of the above states that Tesla insurance doesn’t support yet, too.

Get an electric vehicle insurance quote in 5 states from Clearcover insurance.

Get a Quote from Clearcover ⚡️

They even insure Rideshare drivers and everything is done online from the comfort of your own home. Since they are still a relatively small company compared to the likes of Root and Farmers, their packages aren’t quite as broad. However, the rates are more affordable and the process is simple with their AI who helps you every step of the way.

One part we like about Clearcover is that they have a no advertising policy, putting the savings towards your quote: so the money that would have gone towards a Super Bowl ad will now go towards savings on your Tesla’s insurance quote.

They also claim that their claim flow is a lot easier than the competition and their pay-outs are faster - up to 36 hour turn-around times!

Part 3: Tesla Insurance Video Reviews

Video Reviews of Tesla Insurance Coverage

A video review of the actual coverage after an accident from Youtube vlogger DragonSpawn, dating September 16:

- He says the claims process was incredibly easy – including in-app scheduling of repairs.

- Fast forwarding to insurance coverage partner Crawford for insurance adjuster.

- Part 2 (post-repair experience) is not yet out, as of November 4, 2019.

An excellent review by Youtube user Tesla Joy, in our opinion the best yet.

Best Tesla Insurance for Tesla Model 3

Tesla has great insurance for their own cars, but a couple of other companies such as the heavy hitters Geico, State Farm, Allstate, and Progressive also offer competitive rates. State Farm has increased premiums while followed suit with an outrageous deductible of $548 for Tesla model 3.

Allstate does offer a few discounts as Root does for safe drivers, they also extend that to students and seniors. If your model three has certain features such as anti-theft devices and anti-lock brakes, you could be eligible for more.

Progressive has one of the lowest recorded rates as far as these larger companies go with them being a top choice for many Tesla drivers. Since Tesla themselves don’t offer insurance outside of California, Progressive and Root are a couple of good options to look at.

Best Tesla Insurance for Tesla Model Y

Since the Tesla insurance launch, all it takes is a few clicks to get a simple estimate. You can tailor the coverage to your unique needs with the “customize coverage” option and adjusting each section. After that you get a monthly premium quote.

The best insurance for the yet to launch Tesla Model Y is completely up to you. Look through our list of suggested insurance providers and download their apps for a projected quote.

Insurance from Tesla themselves will offer a lesser premium of up to 30%. Unfortunately, there is no set date for when this privilege will be extended beyond the sunshine state let alone the rest of the world.

For those who do not live in sunny California, there are a few other options including the revered Root and Clearcover insurance providers.

Similar to Tesla, Root gathers data from Autopilot/Autosteer and determine your risks individually. They believe that driving skills should be reflected in your premium, meaning the riskier you are, the higher the price.

Clearcover is still a young company but already offer very competitive rates, so who knows what kind of amazing deals they will be willing to offer as the company grows.

Root and Clearcover have apps that can be downloaded to your smartphone and all your claims and estimates can be handled directly online. For Tesla users, you can also purchase the insurance online in California or request a quote from your local service provider.

Part 4: Buyer’s Guide for Tesla Insurance

Purchasing insurance can be a tricky ordeal, so it’s only natural you want to make sure you have things figured out. Follow the tips below to finding the best coverage for you.

Things to Look for When You Buy EV Insurance

EV cars are quite a new invention when you look at the big picture, so it’s very easy to purchase a bunch of coverages you may not necessarily need.

Find the best quote – When we say find the best quote, we mean pricing, yes, but also the best coverage for your money. Look at all the big wigs such as State Farm, AAA, Geico, Farmers, etc but also the new players such as Root and Clearcover and find the best estimate. What factors influence your quote – Aside from using different companies and dealing with different agents, factors such as your city to if you’re married and your degree matter. Know what you need – You can go online and get a coverage quote and tailor it to your own needs. Decide what it is you want, maybe even consult with an agent and identify your driving habits and what coverage makes the most sense for you. Consider the premium – Everyone has a budget. Decide what yours is and consider the deductible you are prepared to shell out.

Things to Know When Negotiating Tesla Insurance

Make sure you know what is covered. Traffic Aware Cruise Control and Autopilot – are you insured if accidents happen when these features are enabled?

- It’s hard to steal a Tesla, but what if it happens?

- If Sentry Mode and live cam footage prove it to be the other person’s fault, will you be totally covered? What if you’re at fault?

- Will taking your Tesla in to a Tesla owned body shop mean better deals?

- Will your premiums decrease if you prove to be a more responsible driver?

- Know what you need covered and make sure it’s included.

A Complete Comparison of All Big Providers

State Farm – Being a mutual company, if you go with State Farm, you effectively own a small part of the company. They offer discounts that include good driver discounts, vehicle tracking and loyalty.

Geico – Back in the day, Geico was only for employees of the federal government and military personnel. They have now become accessible to the general public and they offer many packages beyond just auto insurance. Their discounts include cars with certain safety features, military people, students and more.

Progressive – They make up 10% of the US auto insurance market and were the first insurance company to offer driver tracking discounts. They also have the lovely feature allowing you to state the premium you would like to pay and in turn they will let you know what you can get in terms of coverage for that price.

Farmers – Other than being an insurance company and offering auto insurance and even pet insurance, they also offer financial services such as annuities and funds. It’s a nationwide service provider and offers senior driver, good student and multi-policy discounts.

Allstate – Known for providing services through their agents their company also provides online support. They are the parent company of Esurance and also offer a multitude of discounts including multipolicy, good student and good driver among others.

Part 5: FAQ

Why is Tesla insurance more expensive?

This is the question many Tesla and EV car drivers ask. A big part of the reason is due to maintenance and insurance costs and not all auto-body shops can perform these repairs. Also, all the materials used to make Tesla cars are higher-end (made from aluminum) and cost a lot more than the traditional frames of other cars. Since the Tesla brand is ever-evolving, automechanics are not always equipped to do the repairs.

Although Tesla does own a few body shops and will do your repairs for you, the rarity of mechanics with the know-how hikes up your premium.

How do insurance companies make the quotes?

They look at the city in which you reside. Is the area prone to more break-ins and reports of vehicle theft? Do drivers get in more accidents in this region? All of these answers affect your premium.

Electric car insurance just costs more in general. Teslas are more expensive and are prone to more break-ins than let’s say, a Honda Civic.

How expensive is your car? The higher the price, the more expensive your premium. Is it an old or used car? This also matters when you’re getting a quote. A used car will have a lower premium due to vehicle depreciation.

We talked about other factors such as your marital status, degree, how your car is financed will reflect on how reliable a person you are.

Last but not least, the model of your EV car will affect your overall price as well.

Are EVs really more expensive to repair?

Part of the contributing factor is the expertise it requires to repair an EV car which not all mechanics and body shops have.

If the battery pack is damaged, then it brings in a whole ton of labor costs to assess the repairs and actually replace it.

As far as Teslas go, the raw materials used to manufacture these cars are also sturdier and more expensive, which no doubt contributes to the higher price tag.

However, it’s rare to witness an accident that requires a huge overall of all the parts, so even though it is about 5-8% more expensive, compared to ICE (internal combustion engine) vehicles, you aren’t looking at detrimental differences.

Which company has the best rate in California?

For the Tesla model 3, you’re looking at Electrade.app (backed by Clearcover) for the best rates in the state. Next up is Geico followed by Allstate both with at least a 30 dollar higher premium compared to Electrade.app.

Why Teslas should be cheaper to insure

There are a slew of reasons as to why these amazing pieces of tech should be cheaper than ICE vehicles to insure.

Since they are “smart” cars, they are less likely to be involved in a wreck, and the driver and passengers are safer in a Tesla due to not having a large internal combustible engine.

They are better built with less moving parts, which decreases the likelihood of a major car wreck.

If they are stolen, the tracking devices make it easy to locate the vehicle.

The next part is subjective, but EV car drivers tend to have better driving records.

All of these factors contribute to why Teslas and other EV cars should be cheaper to insure.

Is your insurance going to go up or down when you buy a Tesla?

This is another subjective topic that varies from case to case, but from our research, trade-ins from Toyota, Honda, BMW, and Nissan have resulted in lower premiums when drivers switch to a spiffy Tesla Model 3.

What EVs are cheaper to insure than a Tesla?

While the Tesla Model X and S have proven to be on the more expensive side to insure, the Model 3 actually costs less to insure than a BMWi3.

Other cheaper EVs than a Tesla include:

- Hyundai Kona EV

- Hyundai IONIQ Electric

- Volkswagen e-Golf

- Nissan Leaf

- Kia Soul EV

- Fiat 500e

Thank you for reading, and thank you for being part of the EV revolution! ⚡️